Some prominent institutional bond investors are shifting their focus away from traditional benchmark indices that weight countries’ debt issues by market capitalization, toward GDP-weighted indices. PIMCO (Pacific Investment Management Company, LLC, the world’s largest fixed-income investment firm) and the Government Pension Fund of Norway (one of the world’s largest Sovereign Wealth Funds), have both recently made moves in this direction.

There is a danger that some investors will lose sight of the purpose of a benchmark index. The benchmark exists to represent the views of the median investor dollar. For many investors, going with the benchmark is a good guideline - especially those who recognize themselves to be relatively unsophisticated and also those who think they are sophisticated but really aren’t. This is the implication of the Efficient Markets Hypothesis (EMH), for example.

On the one hand, EMH theorists are often too quick to discount the possibility of ways to beat the benchmark. To take an example, it should not have been so hard to figure out during the 2003-07 credit-fed boom that countries with high foreign-exchange-denominated debt, particularly in Europe, were not paying a sufficiently high return to compensate for risk. That mistake described Eastern European countries with low ratios of reserves to short-term debt as well as periphery euro members that lacked their own currency. It probably resulted from easy money, reach for yield, and pervasive underestimation of risk. Or, to take another example (admittedly, a tougher call), some of these countries’ deeply discounted bonds would have been good buys in early 2012, after heavy mark-downs.

On the other hand, most investors would do better if they went with a more passive investment strategy - especially due to high management fees among actively managed funds, exacerbated by excessive turnover. At a minimum, if one is pursuing an activist strategy such as investing more in low-debt countries, it is helpful to frame it explicitly as a departure from the view of the median investor in order to be clear in your mind as to the nature of the bet you are making.

I can think of four functions of a benchmark index. First, investors who do not figure that they can systematically beat the median investor need to be able to hold passively a portfolio designed to track a benchmark index consisting median investor holdings. (See Vanguard.) The second function is to provide an objective standard by which investors can judge the performance of active portfolio-managers who claim to be able to beat the median investor, within a specific asset class like sovereign debt. (See Morningstar.) Third, the same weights that are used in the index can be used to compute an average interest rate or sovereign spread in the market, which can serve as an indicator as to where the median investor is currently, in the risk-on, risk-off spectrum. (See J.P.Morgan’s EMBI — Emerging Market Bond Index.)

The fourth function of a benchmark index is to help active investors to devise a deliberate strategy to depart from the views of the median investor when they think that the latter is erring in a particular direction. They may think that the median investor is under-estimating risk in general (spreads too low) or under-estimating the downside in countries with some particular characteristic. Examples of such characteristics include insufficient currency flexibility, inadequate reserves, too much short-term debt, too much foreign-currency debt, too much bank debt, insufficient openness to FDI, insufficient cost competitiveness, excessive budget deficits, insufficient national saving, political risk, and so forth.

For each of these four functions of a benchmark, the correct way of weighting different countries is by market capitalization. True, the keeper of the index will need to judge what countries and what bonds are in “the market,” i.e., are fully investable. But this is true for any index.

The logic behind the movement away from traditional bond market indices is that by construction they give a lot of weight to countries with high debt, some of which may be over-indebted and at risk of default. At first the logic seems unassailable. But in theory, if the market is functioning well, it should already have factored in high debt levels: such countries should pay higher interest rates to compensate for the risk, unless there is some special reason to think they can service their debts easily.

It is important to emphasize that many investors will want to depart from the benchmark in various directions, as indicated under the fourth motive for having a benchmark. An investor’s belief that countries with high debt/GDP ratios are riskier than the median investor realizes would call for a strategy equivalent to moving from the market-cap benchmark in the direction of the GDP-weighted benchmark. But one is more likely to think about the strategy clearly if it is explicitly phrased in terms of factoring in debt/GDP ratios, rather than phrased as following a new GDP-weighted index. Furthermore the phrasing may help an investor realize that he or she might want to modify the strategy if, for example, the country in question can borrow readily in terms of its own currency (think of American exorbitant privilege or Japan’s high domestic holdings of own debt) or if, on the other hand, its debt has a particularly vulnerable maturity or currency structure (think of Hungary).

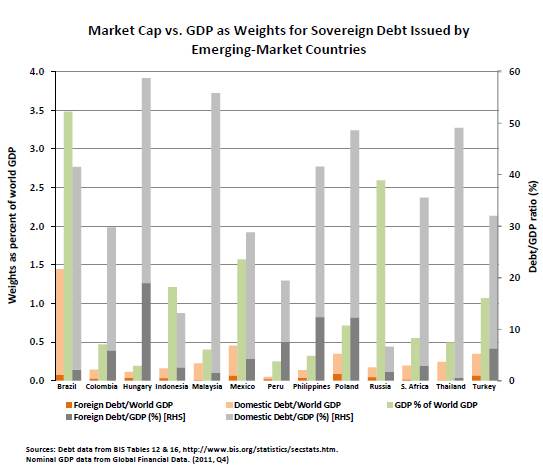

Investors are reacting to what has turned out to be default risk that was higher than they had expected, among some high-debt countries. Taking greater note of high debt levels last decade would have warned investors away from countries like Greece and Hungary. But there is always a danger of fighting the last war. Middle-income countries have paid down much of their debts over the last decade, attaining debt/GDP ratios far below those of advanced economies. As the chart shows, major emerging markets have relatively low debts [first bars, for each country] compared to GDP [second bar]. That is, their debt/GDP ratios [third bar] are now much lower than in advanced countries. (Russia’s sovereign debt is now below 7 per cent of GDP.) As a result, there is only a limited supply of their bonds left to hold. If the global investor community switches from market-cap-weighted to GDP-weighted investing, the high demand and low supply of bonds from low debt/GDP countries may drive their interest rates to unnaturally low levels, setting off new credit-fed boom-bust cycles in their economies.

Many emerging market countries have paid down debt denominated in dollars or other foreign currencies, while continuing to borrow in their local currencies. (See the table at bottom.) Such relatively large countries as Thailand, Malaysia, Indonesia, South Africa and Russia, for example, have little dollar-denominated debt left - 3% of GDP or less (shown in the chart as the dark bottom of each first bar). If an international bond benchmark is to be limited to dollar-denominated debt, then GDP weights could imply a severe imbalance between international investor demand for these countries’ bonds and the small supplies available.

Accordingly, local currency denominated debt must be included in the most useful benchmarks. But then a portfolio reallocation away from traditional benchmark indices such as the EMBI would imply a big shift in allocations away from simple credit risk toward currency risk. True, the ability of emerging market economies to attract foreign investment in their local currencies represents an important strengthening of the global financial system, relative to the currency mismatch and balance sheet vulnerabilities of the 1990s. Nevertheless, an investor switching from one “benchmark” to the other needs to be aware of the extent to which the reduction in default risk comes at the expense of heighted exposure to currency risk.

In short, it is not crazy for an investor to depart from the market-cap-weighted benchmark in the direction of putting more weight on debt/GDP countries and less weight on high debt/GDP countries. But the GDP-weighted index should not be mistaken for a neutral benchmark.

Table: Sovereign debts as a percentage of GDP

| Country | Foreign Debt | Local Debt | Total Debt |

| Brazil | 2.13 | 56.07 | 58.20 |

| Colombia | 5.89 | 23.85 | 29.74 |

| Hungary | 18.93 | 30.89 | 49.82 |

| Indonesia | 2.56 | 12.96 | 15.51 |

| Malaysia | 1.46 | 44.94 | 46.40 |

| Mexico | 4.23 | 24.48 | 28.71 |

| Peru | 7.53 | 6.91 | 14.44 |

| Philippines | 12.35 | 29.19 | 41.54 |

| Poland | 12.28 | 36.32 | 48.61 |

| Russia | 1.76 | 4.82 | 6.57 |

| South Africa | 2.84 | 32.45 | 35.30 |

| Thailand | 0.12 | 24.49 | 24.41 |

| Turkey | 6.25 | 25.95 | 32.30 |

2011, Q4. Sources: Debt data from BIS, Tables 12 & 16. Nominal GDP from Global Financial Data

Some prominent institutional bond investors are shifting their focus away from traditional benchmark indices that weight countries’ debt issues by market capitalization, toward GDP-weighted indices. PIMCO (Pacific Investment Management Company, LLC, the world’s largest fixed-income investment firm) and the Government Pension Fund of Norway (one of the world’s largest Sovereign Wealth Funds), have both recently made moves in this direction.

There is a danger that some investors will lose sight of the purpose of a benchmark index. The benchmark exists to represent the views of the median investor dollar. For many investors, going with the benchmark is a good guideline - especially those who recognize themselves to be relatively unsophisticated and also those who think they are sophisticated but really aren’t. This is the implication of the Efficient Markets Hypothesis (EMH), for example.

On the one hand, EMH theorists are often too quick to discount the possibility of ways to beat the benchmark. To take an example, it should not have been so hard to figure out during the 2003-07 credit-fed boom that countries with high foreign-exchange-denominated debt, particularly in Europe, were not paying a sufficiently high return to compensate for risk. That mistake described Eastern European countries with low ratios of reserves to short-term debt as well as periphery euro members that lacked their own currency. It probably resulted from easy money, reach for yield, and pervasive underestimation of risk. Or, to take another example (admittedly, a tougher call), some of these countries’ deeply discounted bonds would have been good buys in early 2012, after heavy mark-downs.

On the other hand, most investors would do better if they went with a more passive investment strategy - especially due to high management fees among actively managed funds, exacerbated by excessive turnover. At a minimum, if one is pursuing an activist strategy such as investing more in low-debt countries, it is helpful to frame it explicitly as a departure from the view of the median investor in order to be clear in your mind as to the nature of the bet you are making.

I can think of four functions of a benchmark index. First, investors who do not figure that they can systematically beat the median investor need to be able to hold passively a portfolio designed to track a benchmark index consisting median investor holdings. (See Vanguard.) The second function is to provide an objective standard by which investors can judge the performance of active portfolio-managers who claim to be able to beat the median investor, within a specific asset class like sovereign debt. (See Morningstar.) Third, the same weights that are used in the index can be used to compute an average interest rate or sovereign spread in the market, which can serve as an indicator as to where the median investor is currently, in the risk-on, risk-off spectrum. (See J.P.Morgan’s EMBI — Emerging Market Bond Index.)

The fourth function of a benchmark index is to help active investors to devise a deliberate strategy to depart from the views of the median investor when they think that the latter is erring in a particular direction. They may think that the median investor is under-estimating risk in general (spreads too low) or under-estimating the downside in countries with some particular characteristic. Examples of such characteristics include insufficient currency flexibility, inadequate reserves, too much short-term debt, too much foreign-currency debt, too much bank debt, insufficient openness to FDI, insufficient cost competitiveness, excessive budget deficits, insufficient national saving, political risk, and so forth.

SUMMER SALE: Save 40% on all new Digital or Digital Plus subscriptions

Subscribe now to gain greater access to Project Syndicate – including every commentary and our entire On Point suite of subscriber-exclusive content – starting at just $49.99

Subscribe Now

For each of these four functions of a benchmark, the correct way of weighting different countries is by market capitalization. True, the keeper of the index will need to judge what countries and what bonds are in “the market,” i.e., are fully investable. But this is true for any index.

The logic behind the movement away from traditional bond market indices is that by construction they give a lot of weight to countries with high debt, some of which may be over-indebted and at risk of default. At first the logic seems unassailable. But in theory, if the market is functioning well, it should already have factored in high debt levels: such countries should pay higher interest rates to compensate for the risk, unless there is some special reason to think they can service their debts easily.

It is important to emphasize that many investors will want to depart from the benchmark in various directions, as indicated under the fourth motive for having a benchmark. An investor’s belief that countries with high debt/GDP ratios are riskier than the median investor realizes would call for a strategy equivalent to moving from the market-cap benchmark in the direction of the GDP-weighted benchmark. But one is more likely to think about the strategy clearly if it is explicitly phrased in terms of factoring in debt/GDP ratios, rather than phrased as following a new GDP-weighted index. Furthermore the phrasing may help an investor realize that he or she might want to modify the strategy if, for example, the country in question can borrow readily in terms of its own currency (think of American exorbitant privilege or Japan’s high domestic holdings of own debt) or if, on the other hand, its debt has a particularly vulnerable maturity or currency structure (think of Hungary).

Investors are reacting to what has turned out to be default risk that was higher than they had expected, among some high-debt countries. Taking greater note of high debt levels last decade would have warned investors away from countries like Greece and Hungary. But there is always a danger of fighting the last war. Middle-income countries have paid down much of their debts over the last decade, attaining debt/GDP ratios far below those of advanced economies. As the chart shows, major emerging markets have relatively low debts [first bars, for each country] compared to GDP [second bar]. That is, their debt/GDP ratios [third bar] are now much lower than in advanced countries. (Russia’s sovereign debt is now below 7 per cent of GDP.) As a result, there is only a limited supply of their bonds left to hold. If the global investor community switches from market-cap-weighted to GDP-weighted investing, the high demand and low supply of bonds from low debt/GDP countries may drive their interest rates to unnaturally low levels, setting off new credit-fed boom-bust cycles in their economies.

Many emerging market countries have paid down debt denominated in dollars or other foreign currencies, while continuing to borrow in their local currencies. (See the table at bottom.) Such relatively large countries as Thailand, Malaysia, Indonesia, South Africa and Russia, for example, have little dollar-denominated debt left - 3% of GDP or less (shown in the chart as the dark bottom of each first bar). If an international bond benchmark is to be limited to dollar-denominated debt, then GDP weights could imply a severe imbalance between international investor demand for these countries’ bonds and the small supplies available.

Accordingly, local currency denominated debt must be included in the most useful benchmarks. But then a portfolio reallocation away from traditional benchmark indices such as the EMBI would imply a big shift in allocations away from simple credit risk toward currency risk. True, the ability of emerging market economies to attract foreign investment in their local currencies represents an important strengthening of the global financial system, relative to the currency mismatch and balance sheet vulnerabilities of the 1990s. Nevertheless, an investor switching from one “benchmark” to the other needs to be aware of the extent to which the reduction in default risk comes at the expense of heighted exposure to currency risk.

In short, it is not crazy for an investor to depart from the market-cap-weighted benchmark in the direction of putting more weight on debt/GDP countries and less weight on high debt/GDP countries. But the GDP-weighted index should not be mistaken for a neutral benchmark.

Table: Sovereign debts as a percentage of GDP

2011, Q4. Sources: Debt data from BIS, Tables 12 & 16. Nominal GDP from Global Financial Data