The recent release of a revised set of GDP statistics by Britain’s Office for National Statistics showed that growth had not quite, as previously thought, been negative for two consecutive quarters in the winter of 2011-12. The point, as it was reported, was that a UK recession (a second dip after the Great Recession of 2008-09) was now erased from the history books -- and that the Conservative government would take a bit of satisfaction from this fact. But it should not.

Similarly, in April of this year, Britain was reported to have narrowly escaped a second quarter of negative growth, and thereby escaped a triple dip recession. But it could have saved itself the angst.

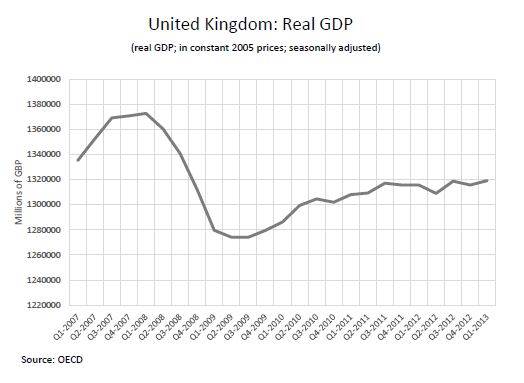

The right question is not whether there have been double or triple dips; the question is whether it has been the same one big recession all along. As the British know all too well, their economy since the low-point of mid-2009 has not yet climbed even halfway out of the hole that it fell into in 2008: GDP (Gross Domestic Product, which is aggregate national output) is still almost 4% below its previous peak. If the criteria for determining recessions in European countries were similar to those used in the United States, the Great Recession would probably not have been declared over in 2009 in the first place.

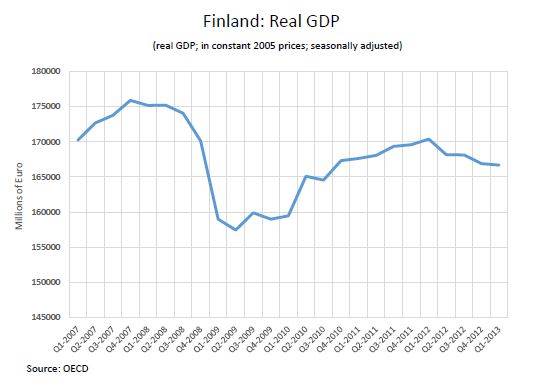

Similarly, it was recently reported that Finland had entered its third recession since the global financial crisis. But the second one (two negative quarters that were reported for 2009 Q4 and 2010 Q1) would be better described as a continuation of the first.

Recent reports that Ireland entered a new recession in early 2013 would also read differently if American criteria were applied. Irish GDP since 2009 has not yet recovered more than half of the ground it lost between the peak of late-2007 and the bottom two years later. Following US methods, the end would not yet have been declared to the initial big recession in Ireland. As it is, a sequence of tentative mini-recoveries have been heralded, only to give way to “double-dips.”

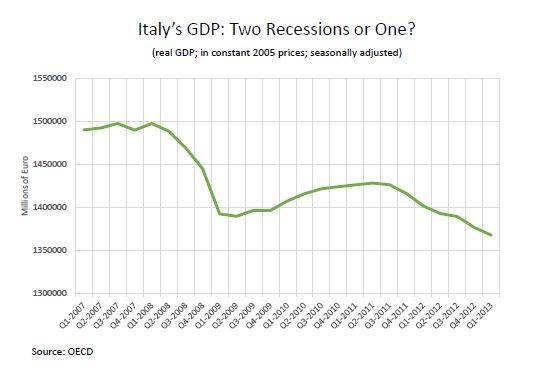

Worse, Italy under U.S. standards would clearly be treated as having been in the same horrific five-year recession ever since the shock of the global financial crisis: the recovery in 2010 was so tepid that the level of Italian economic output had barely risen one-third the way off the floor by 2011, before a new downturn set in. And that new downturn has been severe: Italy’s GDP is now about 8% below the level of 2008, as the graph shows.

The preceding peak is not always the right benchmark. On the one hand, that level of GDP may set too high a bar if it was above potential output, as in the particular case of the housing bubbles of the last decade. On the other hand, the preceding peak may be too low a benchmark because potential output has risen during the intervening months, especially in the case of developing countries with rapid trend growth in the labor force or productivity.

These issues sound like minor technical details. But they are not necessarily without real importance.

First, what is the difference in criteria, anyway? Economists in general define a recession as a period of declining economic activity. European countries, like most, use a simple rule of thumb: a recession is defined as two consecutive quarters of falling GDP. In the United States, the arbiter of when recessions begin and end is the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER). The NBER Committee does not use that rule of thumb, nor any other quantifiable rule, when it declares the peaks and troughs of the US economy. When it makes its judgments it looks beyond the most recently reported GDP numbers to include also employment and a variety other indicators, in part because output measures are subject to errors and revisions. Furthermore the Committee sees nothing special in the criterion of two consecutive quarters. For example, it generally would say that a recession had taken place if the economy had fallen very sharply in two quarters, even if there had been one intermediate quarter of weak growth in between the other two quarters. Further, if a trough is subsequently followed by several quarters of positive growth the NBER Committee does not necessarily announce that the recession has ended, until the economy has recovered sufficiently well that a hypothetical future downturn would count as a new recession instead of a continuation of the first one.

Fortunately, the US economy has had positive economic growth for the last fifteen consecutive quarters, by any measure, so these issues are not currently active on our side of the Atlantic. But things are not always so quiet. The US economy contracted three quarters in a row in 2001, for example, measured with the revised GDP statistics that are available today. But at the time when the NBER committee declared that there had been a recession in 2001 (based on employment and various other indicators), the official GDP statistics did not show two consecutive quarters of declining output, let alone three. That episode is a good illustration of the benefits of a broader approach to the task of declaring business cycle turning points. The NBER Committee has never yet found it necessary revise a date, let alone erase a recession, once declared.

Although the focus on a two-quarter rule and on currently-reported GDP statistics is common in the rest of the world, the NBER is not the only institution that looks beyond it. An analogous Euro Area Business Cycle Dating Committee was set up ten years ago by the Center for Economic Policy Research in London. This committee declared that the Great Recession ended in the euro area after the 2nd quarter of 2009, the same time as in the US. It also declared that a new second recession started in the latter part of 2011 - a recession that Europe is still in. These were probably the right judgments: growth in the quarters in between the two slump intervals was sufficiently strong in some countries such as Germany so that economic activity on average across the eurozone had by mid-2011 re-attained about 2/3 of the ground that it had lost in 2008-09. Hence two separate European recessions instead of one very long one.

The CEPR committee passes judgment only on the euro economy as a unit, not for individual countries within it, nor for countries like the United Kingdom that are outside the euro. They remain subject to the statistical vagaries of evanescent GDP reports.

One cannot say that the two-quarter rule of thumb used by individual countries in Europe and elsewhere is “wrong.” There are unquestionably big advantages in having an automatic procedure that is simple and transparent, especially if the alternative is delegating the job to a committee of unelected unaccountable ivory-tower economists. The press statements of the NBER Committee tend not to be greeted appreciatively. Many critics express puzzlement each time at the need for a secretive committee, relative to an objective two-quarter rule. (Other critics each time complain that the committee has only said “what everybody has known for a long while”. Some critics have managed both complaints at the same time, even when the two-quarter rule would not have given the answer that “everybody knows”).

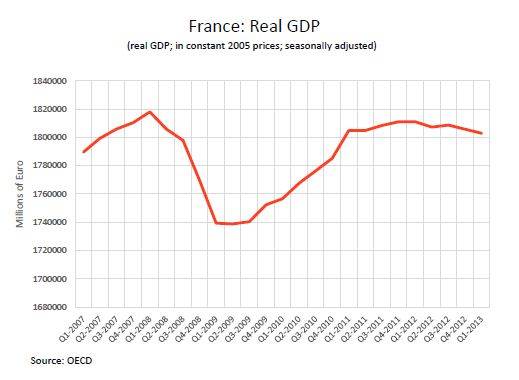

But there are also disadvantages to the rule of thumb. One disadvantage is the need to get out the white-out when the statistics are revised, as Britain is now doing with its vanished recession of 2011-12. Claims that last year appeared in the speeches of UK politicians and in the writings of researchers, made in good faith at the time, have now been rendered false. Similarly, France in May of this year revised away an earlier recession, which would otherwise have been counted as the second since 2008. But it has now reported a new and different second recession, based on the latest statistics for last winter: miniscule declines of 0.2% of GDP in Q4 of 2012 and Q1 of 2013, which should really be considered insignificant.

There is also a potentially more far-reaching and serious disadvantage. Citizens in Ireland and Italy have been given the impression that they have entered new recessions. Voters are likely to draw the conclusion that their political leaders must have done something wrong recently. More likely, these countries have been in the same recession for five years. The implication may be that the leaders have been doing the same wrong things throughout that period. It’s not an unimportant difference.

[NOTE: This post is an extended version of this Project Syndicate column. I would also like to acknowledge the assistance of Ayako Saiki.]

The recent release of a revised set of GDP statistics by Britain’s Office for National Statistics showed that growth had not quite, as previously thought, been negative for two consecutive quarters in the winter of 2011-12. The point, as it was reported, was that a UK recession (a second dip after the Great Recession of 2008-09) was now erased from the history books -- and that the Conservative government would take a bit of satisfaction from this fact. But it should not.

Similarly, in April of this year, Britain was reported to have narrowly escaped a second quarter of negative growth, and thereby escaped a triple dip recession. But it could have saved itself the angst.

The right question is not whether there have been double or triple dips; the question is whether it has been the same one big recession all along. As the British know all too well, their economy since the low-point of mid-2009 has not yet climbed even halfway out of the hole that it fell into in 2008: GDP (Gross Domestic Product, which is aggregate national output) is still almost 4% below its previous peak. If the criteria for determining recessions in European countries were similar to those used in the United States, the Great Recession would probably not have been declared over in 2009 in the first place.

Similarly, it was recently reported that Finland had entered its third recession since the global financial crisis. But the second one (two negative quarters that were reported for 2009 Q4 and 2010 Q1) would be better described as a continuation of the first.

SUMMER SALE: Save 40% on all new Digital or Digital Plus subscriptions

Subscribe now to gain greater access to Project Syndicate – including every commentary and our entire On Point suite of subscriber-exclusive content – starting at just $49.99

Subscribe Now

Recent reports that Ireland entered a new recession in early 2013 would also read differently if American criteria were applied. Irish GDP since 2009 has not yet recovered more than half of the ground it lost between the peak of late-2007 and the bottom two years later. Following US methods, the end would not yet have been declared to the initial big recession in Ireland. As it is, a sequence of tentative mini-recoveries have been heralded, only to give way to “double-dips.”

Worse, Italy under U.S. standards would clearly be treated as having been in the same horrific five-year recession ever since the shock of the global financial crisis: the recovery in 2010 was so tepid that the level of Italian economic output had barely risen one-third the way off the floor by 2011, before a new downturn set in. And that new downturn has been severe: Italy’s GDP is now about 8% below the level of 2008, as the graph shows.

The preceding peak is not always the right benchmark. On the one hand, that level of GDP may set too high a bar if it was above potential output, as in the particular case of the housing bubbles of the last decade. On the other hand, the preceding peak may be too low a benchmark because potential output has risen during the intervening months, especially in the case of developing countries with rapid trend growth in the labor force or productivity.

These issues sound like minor technical details. But they are not necessarily without real importance.

First, what is the difference in criteria, anyway? Economists in general define a recession as a period of declining economic activity. European countries, like most, use a simple rule of thumb: a recession is defined as two consecutive quarters of falling GDP. In the United States, the arbiter of when recessions begin and end is the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER). The NBER Committee does not use that rule of thumb, nor any other quantifiable rule, when it declares the peaks and troughs of the US economy. When it makes its judgments it looks beyond the most recently reported GDP numbers to include also employment and a variety other indicators, in part because output measures are subject to errors and revisions. Furthermore the Committee sees nothing special in the criterion of two consecutive quarters. For example, it generally would say that a recession had taken place if the economy had fallen very sharply in two quarters, even if there had been one intermediate quarter of weak growth in between the other two quarters. Further, if a trough is subsequently followed by several quarters of positive growth the NBER Committee does not necessarily announce that the recession has ended, until the economy has recovered sufficiently well that a hypothetical future downturn would count as a new recession instead of a continuation of the first one.

Fortunately, the US economy has had positive economic growth for the last fifteen consecutive quarters, by any measure, so these issues are not currently active on our side of the Atlantic. But things are not always so quiet. The US economy contracted three quarters in a row in 2001, for example, measured with the revised GDP statistics that are available today. But at the time when the NBER committee declared that there had been a recession in 2001 (based on employment and various other indicators), the official GDP statistics did not show two consecutive quarters of declining output, let alone three. That episode is a good illustration of the benefits of a broader approach to the task of declaring business cycle turning points. The NBER Committee has never yet found it necessary revise a date, let alone erase a recession, once declared.

Although the focus on a two-quarter rule and on currently-reported GDP statistics is common in the rest of the world, the NBER is not the only institution that looks beyond it. An analogous Euro Area Business Cycle Dating Committee was set up ten years ago by the Center for Economic Policy Research in London. This committee declared that the Great Recession ended in the euro area after the 2nd quarter of 2009, the same time as in the US. It also declared that a new second recession started in the latter part of 2011 - a recession that Europe is still in. These were probably the right judgments: growth in the quarters in between the two slump intervals was sufficiently strong in some countries such as Germany so that economic activity on average across the eurozone had by mid-2011 re-attained about 2/3 of the ground that it had lost in 2008-09. Hence two separate European recessions instead of one very long one.

The CEPR committee passes judgment only on the euro economy as a unit, not for individual countries within it, nor for countries like the United Kingdom that are outside the euro. They remain subject to the statistical vagaries of evanescent GDP reports.

One cannot say that the two-quarter rule of thumb used by individual countries in Europe and elsewhere is “wrong.” There are unquestionably big advantages in having an automatic procedure that is simple and transparent, especially if the alternative is delegating the job to a committee of unelected unaccountable ivory-tower economists. The press statements of the NBER Committee tend not to be greeted appreciatively. Many critics express puzzlement each time at the need for a secretive committee, relative to an objective two-quarter rule. (Other critics each time complain that the committee has only said “what everybody has known for a long while”. Some critics have managed both complaints at the same time, even when the two-quarter rule would not have given the answer that “everybody knows”).

But there are also disadvantages to the rule of thumb. One disadvantage is the need to get out the white-out when the statistics are revised, as Britain is now doing with its vanished recession of 2011-12. Claims that last year appeared in the speeches of UK politicians and in the writings of researchers, made in good faith at the time, have now been rendered false. Similarly, France in May of this year revised away an earlier recession, which would otherwise have been counted as the second since 2008. But it has now reported a new and different second recession, based on the latest statistics for last winter: miniscule declines of 0.2% of GDP in Q4 of 2012 and Q1 of 2013, which should really be considered insignificant.

There is also a potentially more far-reaching and serious disadvantage. Citizens in Ireland and Italy have been given the impression that they have entered new recessions. Voters are likely to draw the conclusion that their political leaders must have done something wrong recently. More likely, these countries have been in the same recession for five years. The implication may be that the leaders have been doing the same wrong things throughout that period. It’s not an unimportant difference.

[NOTE: This post is an extended version of this Project Syndicate column. I would also like to acknowledge the assistance of Ayako Saiki.]