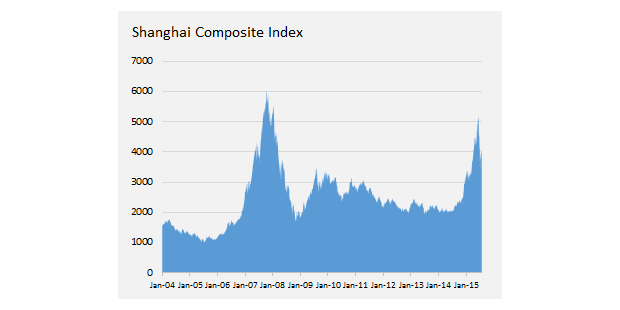

China’s equity markets have been on a roller-coaster ride of late, with the country’s policymakers desperate to apply the brakes. Could the tumult derail China’s reforms, particularly its effort to make the renminbi a truly global currency?

China’s equity markets have been on a roller-coaster ride of late, with the country’s policymakers desperate to apply the brakes. Could the tumult derail China’s reforms, particularly its effort to make the renminbi a truly global currency?

Aug 5, 2015 Alex Friedman views China's recent stock-market volatility through the lens of its reserve-currency ambitions.

Aug 4, 2015 Zhang Jun blames the recent stock-market tumult on the government.

Jul 29, 2015 Michael Spence calls on Chinese leaders to focus on improved regulation, rather than propping up equity prices.

Jul 28, 2015 Linda Yueh explains why government intervention has only caused greater volatility.

Jul 27, 2015 Stephen S. Roach compares China's effort to shore up equity prices to similar measures in the US, Europe, and Japan.

Jul 22, 2015 Zhang Lei explains how partnering with Chinese entrepreneurs for the long term can be profitable.

Jul 17, 2024 Adekeye Adebajo

Jul 19, 2024 Pinelopi Koujianou Goldberg

Jul 18, 2024 Eric Parrado

Jul 17, 2024 Shlomo Ben-Ami