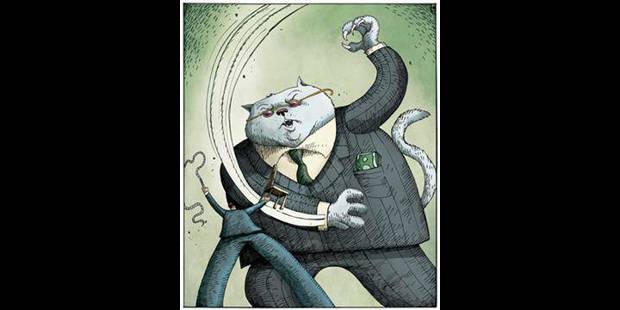

The collapse in 2008 of US investment bank Lehman Brothers triggered the worst financial crisis since the Great Depression, with millions still suffering from the economic downturn and high unemployment that followed. Why, five years later, has regulatory reform lagged and economic recovery remained elusive?