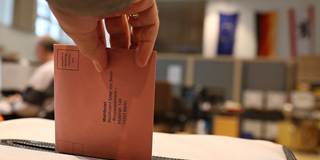

Germany’s Economic Road Ahead

The next German government will have a chance to lay the groundwork for the country's future prosperity. But if policymakers are to make the most of the opportunity, they will have to act neither rashly nor reticently.

The next German government will have a chance to lay the groundwork for the country's future prosperity. But if policymakers are to make the most of the opportunity, they will have to act neither rashly nor reticently.

MUNICH – The next German government will face economic-policy challenges in five key areas: digitalization and automation, demographic change, globalization, climate change, and European integration.