Paul De Grauwe

Paul De Grauwe is Chair of European Political Economy for the European Institute at the London School of Economics.

-

Tame Inflation Without Subsidizing Banks

Tame Inflation Without Subsidizing Banks

Feb 27, 2023 Paul De Grauwe & Yuemei Ji urge central banks to increase minimum reserve requirements as a temporary measure to prevent huge losses.

-

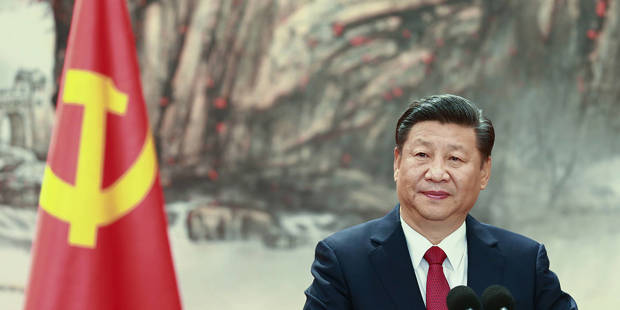

China's Time for Global Leadership

Free to read

Free to readChina's Time for Global Leadership

Mar 17, 2022 Stephen S. Roach, et al. call on the country's leaders to leverage their partnership with Russia to stand up for peace in Ukraine.

-

Russia Is Too Small to Win

Russia Is Too Small to Win

Mar 17, 2022 Paul De Grauwe highlights the economic weaknesses that are likely to deny Vladimir Putin a victory in Ukraine.

-

Brexit and the Brussels Effect

Brexit and the Brussels Effect

Dec 18, 2020 Paul De Grauwe calls for the UK and the EU to retain full sovereignty and let the market compel alignment on trade rules.

-

The ECB Must Finance COVID-19 Deficits

The ECB Must Finance COVID-19 Deficits

Mar 18, 2020 Paul De Grauwe makes the case that policymakers should accept the necessity of monetary financing to avert a deeper crisis.