The US has plenty of experience with irresponsible tax cuts. Yet its leaders seem not to have learned their lesson. Should Republicans secure the legislative victory they so desire, the entire country – with the exception, perhaps, of the wealthiest few – will lose.

WASHINGTON, DC – Congressional Republicans must, President Donald Trump has commanded, pass their sweeping US tax bill by Christmas. Otherwise, they will have no major accomplishment to show for an entire year during which they have controlled the legislative and executive branches of government. Having apparently failed in their seven-year campaign to deprive millions of Americans of health insurance, they dare not fail in their Scrooge-like campaign to transfer billions of dollars from the middle class to the ultra-rich.

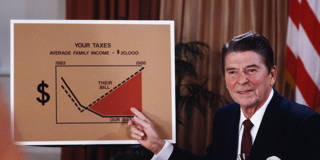

In an effort to rally support for the tax bill, Trump recently sought to invoke Ronald Reagan’s tax initiatives of the 1980s. And he has a point, though not the one he intended. Recalling what transpired under Reagan might shed some light on the Republicans’ murky current proposals.

There were actually two huge tax bills during the Reagan years – the Economic Recovery Tax Act of 1981 and the Tax Reform Act of 1986 – and they differed in almost every respect. The 1981 legislation was not true tax reform, but a rushed and poorly coordinated frenzy of fiscally irresponsible cuts to both corporate and personal income taxes. The 1986 law was the well-thought-out result of an extended, deliberate, and bipartisan process, designed to be revenue-neutral, with low marginal income tax rates balanced by fewer deductions, particularly on the corporate side.

WASHINGTON, DC – Congressional Republicans must, President Donald Trump has commanded, pass their sweeping US tax bill by Christmas. Otherwise, they will have no major accomplishment to show for an entire year during which they have controlled the legislative and executive branches of government. Having apparently failed in their seven-year campaign to deprive millions of Americans of health insurance, they dare not fail in their Scrooge-like campaign to transfer billions of dollars from the middle class to the ultra-rich.

In an effort to rally support for the tax bill, Trump recently sought to invoke Ronald Reagan’s tax initiatives of the 1980s. And he has a point, though not the one he intended. Recalling what transpired under Reagan might shed some light on the Republicans’ murky current proposals.

There were actually two huge tax bills during the Reagan years – the Economic Recovery Tax Act of 1981 and the Tax Reform Act of 1986 – and they differed in almost every respect. The 1981 legislation was not true tax reform, but a rushed and poorly coordinated frenzy of fiscally irresponsible cuts to both corporate and personal income taxes. The 1986 law was the well-thought-out result of an extended, deliberate, and bipartisan process, designed to be revenue-neutral, with low marginal income tax rates balanced by fewer deductions, particularly on the corporate side.