No one should be surprised at the collapse of the crypto exchange FTX – not even at how many people were surprised. Despite the novelty of the assets, the narrative of the crypto crisis was established long ago.

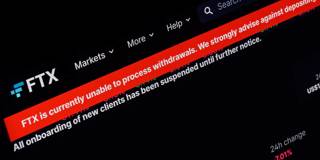

BARCELONA – Swiftly rising interest rates have punctured the cryptocurrency bubble, exposing fragility, bad governance, and even fraud in many corners, most notably at the crypto exchange FTX. And FTX’s spectacular collapse comes on the heels of other recent failures in the cryptosphere, such as Terra-Luna, Three Arrows Capital, or Voyager Digital. No one should be surprised – not even at how many people were surprised.

“There is no new thing under the sun,” Ecclesiastes reminds us. At FTX’s headquarters under the Bahamian sun, the firm’s advertising admonished customers not to “miss out” on “the next big thing” – blockchain-based currencies, financial products, and non-fungible tokens. But only the assets were new. The narrative of the crypto crisis was established long ago.

The collapse began, as financial collapses often do, with a bubble. Investor demand outpaced reasonable near-term expectations of what cryptocurrencies could achieve. Impractical as a means of exchange, the uses of Bitcoin, Ethereum, and the rest seemed limited to financial speculation and illegal activity. But historically low interest rates fueled the mania for what crypto could become. Due dilligence took a back seat to skyrocketing asset prices. Cheap money made it easier for firms to take on excessive leverage. Investors needed increasingly bigger returns to outpace the market and beat their competition. This meant more leverage and more risk-taking.

BARCELONA – Swiftly rising interest rates have punctured the cryptocurrency bubble, exposing fragility, bad governance, and even fraud in many corners, most notably at the crypto exchange FTX. And FTX’s spectacular collapse comes on the heels of other recent failures in the cryptosphere, such as Terra-Luna, Three Arrows Capital, or Voyager Digital. No one should be surprised – not even at how many people were surprised.

“There is no new thing under the sun,” Ecclesiastes reminds us. At FTX’s headquarters under the Bahamian sun, the firm’s advertising admonished customers not to “miss out” on “the next big thing” – blockchain-based currencies, financial products, and non-fungible tokens. But only the assets were new. The narrative of the crypto crisis was established long ago.

The collapse began, as financial collapses often do, with a bubble. Investor demand outpaced reasonable near-term expectations of what cryptocurrencies could achieve. Impractical as a means of exchange, the uses of Bitcoin, Ethereum, and the rest seemed limited to financial speculation and illegal activity. But historically low interest rates fueled the mania for what crypto could become. Due dilligence took a back seat to skyrocketing asset prices. Cheap money made it easier for firms to take on excessive leverage. Investors needed increasingly bigger returns to outpace the market and beat their competition. This meant more leverage and more risk-taking.