To commemorate its founding 25 years ago, PS will be republishing over the coming months a selection of commentaries written since 1994. In the following commentary, Joseph E. Stiglitz argued that the best route to deficit reduction in the US was not budget cuts, but stronger growth.

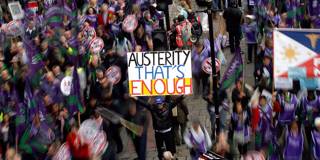

NEW YORK – In the aftermath of the Great Recession, countries have been left with unprecedented peacetime deficits and increasing anxieties about their growing national debts. In many countries, this is leading to a new round of austerity – policies that will almost surely lead to weaker national and global economies and a marked slowdown in the pace of recovery. Those hoping for large deficit reductions will be sorely disappointed, as the economic slowdown will push down tax revenues and increase demands for unemployment insurance and other social benefits.

The attempt to restrain the growth of debt does serve to concentrate the mind – it forces countries to focus on priorities and assess values. The United States is unlikely in the short term to embrace massive budget cuts, à la the United Kingdom. But the long-term prognosis – made especially dire by health-care reform’s inability to make much of a dent in rising medical costs – is sufficiently bleak that there is increasing bipartisan momentum to do something. President Barack Obama has appointed a bipartisan deficit-reduction commission, whose chairmen recently provided a glimpse of what their report might look like.

Technically, reducing a deficit is a straightforward matter: one must either cut expenditures or raise taxes. It is already clear, however, that the deficit-reduction agenda, at least in the US, goes further: it is an attempt to weaken social protections, reduce the progressivity of the tax system, and shrink the role and size of government – all while leaving established interests, like the military-industrial complex, as little affected as possible.

NEW YORK – In the aftermath of the Great Recession, countries have been left with unprecedented peacetime deficits and increasing anxieties about their growing national debts. In many countries, this is leading to a new round of austerity – policies that will almost surely lead to weaker national and global economies and a marked slowdown in the pace of recovery. Those hoping for large deficit reductions will be sorely disappointed, as the economic slowdown will push down tax revenues and increase demands for unemployment insurance and other social benefits.

The attempt to restrain the growth of debt does serve to concentrate the mind – it forces countries to focus on priorities and assess values. The United States is unlikely in the short term to embrace massive budget cuts, à la the United Kingdom. But the long-term prognosis – made especially dire by health-care reform’s inability to make much of a dent in rising medical costs – is sufficiently bleak that there is increasing bipartisan momentum to do something. President Barack Obama has appointed a bipartisan deficit-reduction commission, whose chairmen recently provided a glimpse of what their report might look like.

Technically, reducing a deficit is a straightforward matter: one must either cut expenditures or raise taxes. It is already clear, however, that the deficit-reduction agenda, at least in the US, goes further: it is an attempt to weaken social protections, reduce the progressivity of the tax system, and shrink the role and size of government – all while leaving established interests, like the military-industrial complex, as little affected as possible.