Two of the world’s most prominent economic institutions, the IMF and Larry Summers, recently warned that the global economy may be facing an extended period of low interest rates. Why is that a bad thing, and what can be done about it?

BERKELEY – Two of the world’s most prominent economic institutions, the International Monetary Fund and Former US Treasury Secretary Larry Summers, recently warned that the global economy may be facing an extended period of low interest rates. Why is that a bad thing, and what can be done about it?

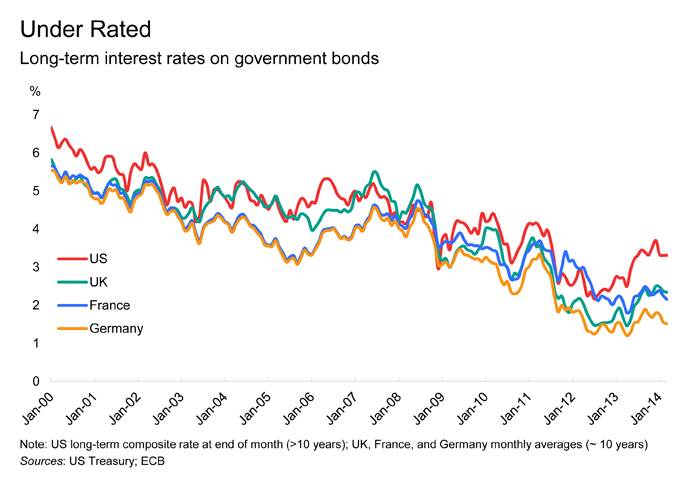

Adjusted for inflation, interest rates have been falling for three decades, and their current low level encourages investors, searching for yield, to take on additional risk. Low rates also leave central banks little room for loosening monetary policy in a slowdown, because nominal interest cannot fall below zero. And they are symptomatic of an economy that is out of sorts.

BERKELEY – Two of the world’s most prominent economic institutions, the International Monetary Fund and Former US Treasury Secretary Larry Summers, recently warned that the global economy may be facing an extended period of low interest rates. Why is that a bad thing, and what can be done about it?

Adjusted for inflation, interest rates have been falling for three decades, and their current low level encourages investors, searching for yield, to take on additional risk. Low rates also leave central banks little room for loosening monetary policy in a slowdown, because nominal interest cannot fall below zero. And they are symptomatic of an economy that is out of sorts.