The negotiations to create a free-trade area between the US and Europe, and another between the US and much of the Pacific (except for China), are not about establishing a true free-trade system. Instead, the goal is a managed trade regime – managed, that is, to serve the special interests that have long dominated trade policy in the West.

NEW YORK – Though nothing has come of the World Trade Organization’s Doha Development Round of global trade negotiations since they were launched almost a dozen years ago, another round of talks is in the works. But this time the negotiations will not be held on a global, multilateral basis; rather, two huge regional agreements – one transpacific, and the other transatlantic – are to be negotiated. Are the coming talks likely to be more successful?

The Doha Round was torpedoed by the United States’ refusal to eliminate agricultural subsidies – a sine qua non for any true development round, given that 70% of those in the developing world depend on agriculture directly or indirectly. The US position was truly breathtaking, given that the WTO had already judged that America’s cotton subsidies – paid to fewer than 25,000 rich farmers – were illegal. America’s response was to bribe Brazil, which had brought the complaint, not to pursue the matter further, leaving in the lurch millions of poor cotton farmers in Sub-Saharan Africa and India, who suffer from depressed prices because of America’s largesse to its wealthy farmers.

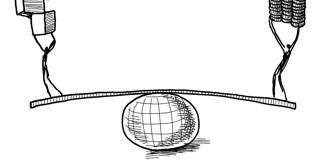

Given this recent history, it now seems clear that the negotiations to create a free-trade area between the US and Europe, and another between the US and much of the Pacific (except for China), are not about establishing a true free-trade system. Instead, the goal is a managed trade regime – managed, that is, to serve the special interests that have long dominated trade policy in the West.

NEW YORK – Though nothing has come of the World Trade Organization’s Doha Development Round of global trade negotiations since they were launched almost a dozen years ago, another round of talks is in the works. But this time the negotiations will not be held on a global, multilateral basis; rather, two huge regional agreements – one transpacific, and the other transatlantic – are to be negotiated. Are the coming talks likely to be more successful?

The Doha Round was torpedoed by the United States’ refusal to eliminate agricultural subsidies – a sine qua non for any true development round, given that 70% of those in the developing world depend on agriculture directly or indirectly. The US position was truly breathtaking, given that the WTO had already judged that America’s cotton subsidies – paid to fewer than 25,000 rich farmers – were illegal. America’s response was to bribe Brazil, which had brought the complaint, not to pursue the matter further, leaving in the lurch millions of poor cotton farmers in Sub-Saharan Africa and India, who suffer from depressed prices because of America’s largesse to its wealthy farmers.

Given this recent history, it now seems clear that the negotiations to create a free-trade area between the US and Europe, and another between the US and much of the Pacific (except for China), are not about establishing a true free-trade system. Instead, the goal is a managed trade regime – managed, that is, to serve the special interests that have long dominated trade policy in the West.