In the late 1980s and early 1990s, the US issued stern, and apparently credible, threats to restrict Japanese imports, which pushed Japan to overvalue the yen and helped to bring Japanese growth to a screeching halt. That may be happening again in China, where growth is slowing markedly under the weight of an overvalued currency.

NEW YORK – China is now experiencing what Japan went through a generation ago: a marked slowdown in economic growth after demands by the United States that it restrict its exports. In the late 1980s and early 1990s, Japan was criticized by the US as an “unfair trader” by virtue of its soaring manufacturing exports. The US issued stern, and apparently credible, threats to restrict Japanese imports, and succeeded in pushing Japan to overvalue the yen, which helped to bring Japanese growth to a screeching halt.

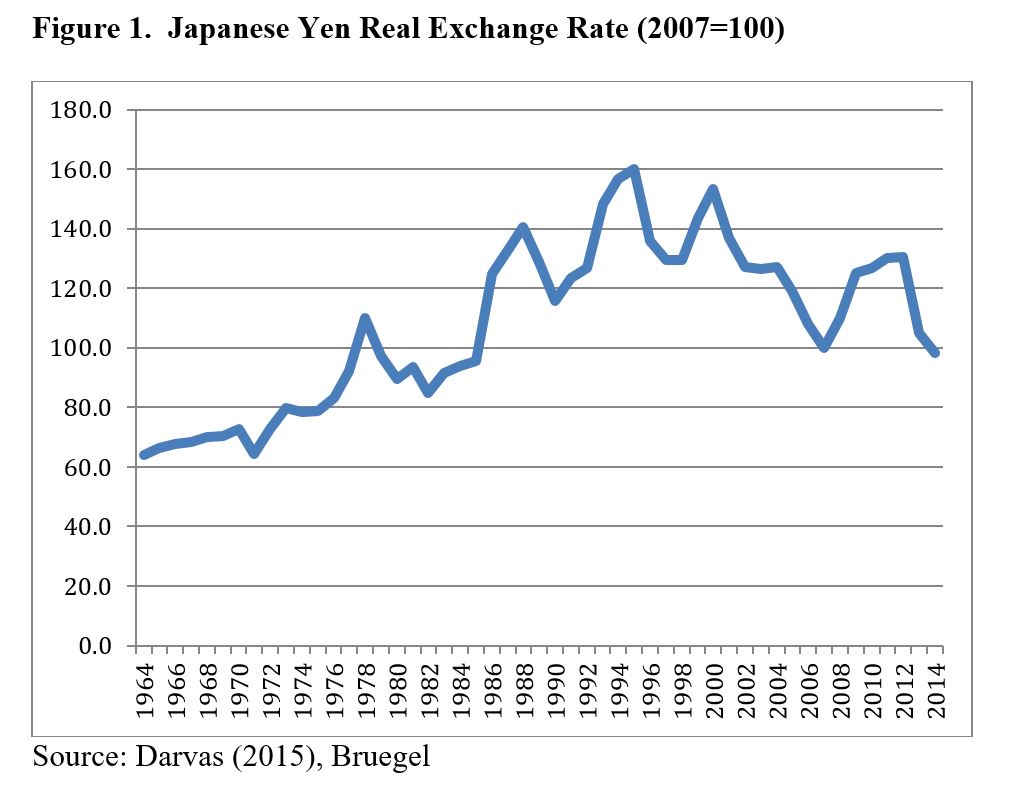

That may be happening again, with China’s growth slowing markedly under the weight of an overvalued currency urged by the US. Figure 1 shows the yen’s real (inflation-adjusted) exchange rate from 1964 (when the yen became convertible on the current account) until today. A rise in the index signifies real appreciation, meaning that the yen became more expensive relative to other currencies after correcting for relative price-level changes.

NEW YORK – China is now experiencing what Japan went through a generation ago: a marked slowdown in economic growth after demands by the United States that it restrict its exports. In the late 1980s and early 1990s, Japan was criticized by the US as an “unfair trader” by virtue of its soaring manufacturing exports. The US issued stern, and apparently credible, threats to restrict Japanese imports, and succeeded in pushing Japan to overvalue the yen, which helped to bring Japanese growth to a screeching halt.

That may be happening again, with China’s growth slowing markedly under the weight of an overvalued currency urged by the US. Figure 1 shows the yen’s real (inflation-adjusted) exchange rate from 1964 (when the yen became convertible on the current account) until today. A rise in the index signifies real appreciation, meaning that the yen became more expensive relative to other currencies after correcting for relative price-level changes.