Everywhere one looks, problems of fiscal policy are now center stage. Among advanced countries, the news is bad: Europe’s periphery teeters, the U.K. slashes, the U.S. deadlocks, Japan muddles. But in the rest of the world there is better news: In an historic reversal, many emerging market and developing countries have over the last decade achieved a countercyclical fiscal policy.

In the past, developing countries tended to follow procyclical fiscal policy: they increased spending (or cut taxes) during periods of expansion and cut spending (or raised taxes) during periods of recession. Many authors have documented that fiscal policy has tended to be procyclical in developing countries, in comparison with a pattern among industrialized countries that has been by and large countercyclical. (References for this proposition and others are available.) Most studies look at the procyclicality of government spending, because tax receipts are particularly endogenous with respect to the business cycle. Indeed, an important reason for procyclical spending is precisely that government receipts from taxes or mineral royalties rise in booms, and the government cannot resist the temptation or political pressure to increase spending proportionately, or even more than proportionately. One can find a similar pattern on the tax side by focusing on tax rates rather than revenues, though cross-country evidence is harder to come by.

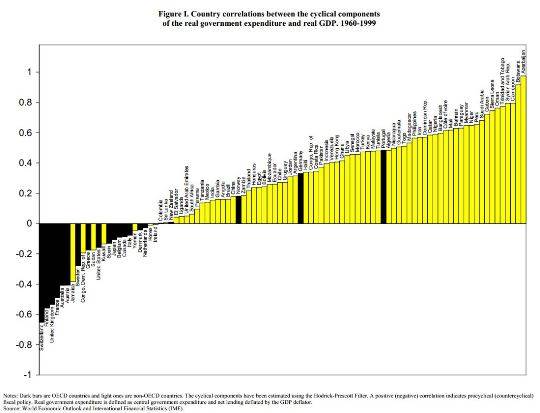

Figure I (which is a version of evidence presented in Kaminsky, Reinhart and Vegh, 2004) depicts the correlation between government spending and GDP for 94 countries over the period 1960-1999. More precisely, it shows the correlation between the cyclical components of spending and GDP; the longer term trends are taken out. The set includes 21 developed countries, which are represented by black bars, and 73 developing countries, represented by yellow bars. A positive correlation indicates government spending that is procyclical, that is, destabilizing. A negative correlation indicates countercyclical spending, that is, stabilizing.

There is no missing the message. Yellow bars lie overwhelmingly on the right hand side: more than 90 percent of developing countries show positive correlations (procyclical spending). Black bars dominate the left hand side: around 80 per cent of industrial countries show negative correlations (countercyclical spending).

Access every new PS commentary, our entire On Point suite of subscriber-exclusive content – including Longer Reads, Insider Interviews, Big Picture/Big Question, and Say More – and the full PS archive.

Subscribe Now

Over the last decade there has been a historic shift in the cyclical behavior of fiscal policy in the developing world. Figure II updates the statistics, showing the period 2000-2009. The number of yellow bars on the left side of the graph (negative correlations) has greatly increased. Around 35 percent of developing countries [26 out of 73] now show a countercyclical fiscal policy, more than quadruple the share during the earlier period.

Figure III presents a scatter plot with the 1960-1999 correlation on the horizontal axis and the 2000-2009 correlation on the vertical axis. The lower right quadrant shows the graduates from procyclical to countercyclical fiscal policy. The star performers include Chile and Botswana; but 24 developing countries altogether (out of 73) have made this historic shift.

The evidence of countercyclicality among many emerging market and developing countries matches up with other criteria for judging maturity in the conduct of fiscal policy: debt/GDP ratios, rankings by rating agencies, and sovereign spreads. Low income and emerging market countries in the aggregate have achieved debt/GDP levels around 40 percent of GDP over the last four years. [The IMF estimates the 2011 ratio at 43 per cent among emerging market countries and 35 per cent among low-income countries]. This is the same period during which debt in advanced countries has risen from about 70 per cent of GDP to 102 percent. The financial markets have ratified the historic turnaround. Spreads are now lower for many emerging markets than for some “advanced countries.” Rating agencies rank Singapore as more creditworthy than Belgium, Korea ahead of Portugal, Mexico ahead of Iceland, and just about everybody ahead of Greece. Euromoneyranks Chile as less risky than Japan, Korea less risky than Italy, Malaysia less risky than Spain, and Brazil less risky than Portugal.

Largely as a result of their improved fiscal situations during the period 2000-2007, many emerging markets were able to bounce back from the 2008-2009 global financial crisis more quickly than advanced countries.

What explains the ability of some countries, particularly emerging market and developing countries, to escape the trap of procyclical fiscal policy? Many researchers have pointed to the importance of institutions. In new research we find that the cyclicality of a country’s fiscal policy is inversely correlated with the country’s institutional quality (which includes measures of law and order, bureaucracy quality, corruption, and other risks to investment). The relationship holds also when instrumental variables are used.

Although one thinks of institutions as slow-moving, they can change over time. Chile’s institutional quality has risen strongly since the early 1980s, during which time its fiscal policy has turned from procyclical to countercyclical. A country with good institutional quality in the general sense of rule of law can help lock in countercyclical fiscal policy through specific budget institutions. Chile did it with the structural budget reforms of 2000 and 2006. Chile’s approach could be emulated by others.

Fiscal rules, such as euroland’s Stability and Growth Pact, may accomplish little in themselves. Rules can actually worsen the tendency of governments to make overly optimistic forecasts for economic growth and budget balance. Chile’s key innovation was to give responsibility for forecasting to independent expert commissions, insulated from politicians’ wishful thinking.

Even advanced countries have something to learn about countercyclical fiscal policy from Chile and others to the South. Saving during expansions such as 2001-06 is critical for weathering the storm in recessions such as 2008-09. Otherwise there may be no way out but to adjust at the worst possible time.

To have unlimited access to our content including in-depth commentaries, book reviews, exclusive interviews, PS OnPoint and PS The Big Picture, please subscribe

From a long list of criminal indictments to unfavorable voter demographics, there is plenty standing between presumptive GOP nominee Donald Trump and a second term in the White House. But a Trump victory in the November election remains a distinct possibility – and a cause for serious economic concern.

Contrary to what former US President Donald Trump would have the American public believe, no president enjoys absolute immunity from criminal prosecution. To suggest otherwise is to reject a bedrock principle of American democracy: the president is not a monarch.

explains why the US Supreme Court must reject the former president's claim to immunity from prosecution.

When comparing Ukraine’s situation in 2024 to Europe’s in 1941, Russia’s defeat seems entirely possible. But it will require the West, and the US in particular, to put aside domestic political squabbles and muster the political will to provide Ukraine with consistent and robust military and financial assistance.

compare Russia's full-scale invasion to World War II and see reason to hope – as long as aid keeps flowing.

This column is co-authored with Carlos Végh and Guillermo Vuletin and was published in VoxEU.

Everywhere one looks, problems of fiscal policy are now center stage. Among advanced countries, the news is bad: Europe’s periphery teeters, the U.K. slashes, the U.S. deadlocks, Japan muddles. But in the rest of the world there is better news: In an historic reversal, many emerging market and developing countries have over the last decade achieved a countercyclical fiscal policy.

In the past, developing countries tended to follow procyclical fiscal policy: they increased spending (or cut taxes) during periods of expansion and cut spending (or raised taxes) during periods of recession. Many authors have documented that fiscal policy has tended to be procyclical in developing countries, in comparison with a pattern among industrialized countries that has been by and large countercyclical. (References for this proposition and others are available.) Most studies look at the procyclicality of government spending, because tax receipts are particularly endogenous with respect to the business cycle. Indeed, an important reason for procyclical spending is precisely that government receipts from taxes or mineral royalties rise in booms, and the government cannot resist the temptation or political pressure to increase spending proportionately, or even more than proportionately. One can find a similar pattern on the tax side by focusing on tax rates rather than revenues, though cross-country evidence is harder to come by.

Figure I (which is a version of evidence presented in Kaminsky, Reinhart and Vegh, 2004) depicts the correlation between government spending and GDP for 94 countries over the period 1960-1999. More precisely, it shows the correlation between the cyclical components of spending and GDP; the longer term trends are taken out. The set includes 21 developed countries, which are represented by black bars, and 73 developing countries, represented by yellow bars. A positive correlation indicates government spending that is procyclical, that is, destabilizing. A negative correlation indicates countercyclical spending, that is, stabilizing.

&

[Click here for enlargement of Figure I.]

There is no missing the message. Yellow bars lie overwhelmingly on the right hand side: more than 90 percent of developing countries show positive correlations (procyclical spending). Black bars dominate the left hand side: around 80 per cent of industrial countries show negative correlations (countercyclical spending).

Subscribe to PS Digital

Access every new PS commentary, our entire On Point suite of subscriber-exclusive content – including Longer Reads, Insider Interviews, Big Picture/Big Question, and Say More – and the full PS archive.

Subscribe Now

Over the last decade there has been a historic shift in the cyclical behavior of fiscal policy in the developing world. Figure II updates the statistics, showing the period 2000-2009. The number of yellow bars on the left side of the graph (negative correlations) has greatly increased. Around 35 percent of developing countries [26 out of 73] now show a countercyclical fiscal policy, more than quadruple the share during the earlier period.

[Click here for enlargement of Figure II.]

Figure III presents a scatter plot with the 1960-1999 correlation on the horizontal axis and the 2000-2009 correlation on the vertical axis. The lower right quadrant shows the graduates from procyclical to countercyclical fiscal policy. The star performers include Chile and Botswana; but 24 developing countries altogether (out of 73) have made this historic shift.

[Click here for enlargement of Figure III.]

The evidence of countercyclicality among many emerging market and developing countries matches up with other criteria for judging maturity in the conduct of fiscal policy: debt/GDP ratios, rankings by rating agencies, and sovereign spreads. Low income and emerging market countries in the aggregate have achieved debt/GDP levels around 40 percent of GDP over the last four years. [The IMF estimates the 2011 ratio at 43 per cent among emerging market countries and 35 per cent among low-income countries]. This is the same period during which debt in advanced countries has risen from about 70 per cent of GDP to 102 percent. The financial markets have ratified the historic turnaround. Spreads are now lower for many emerging markets than for some “advanced countries.” Rating agencies rank Singapore as more creditworthy than Belgium, Korea ahead of Portugal, Mexico ahead of Iceland, and just about everybody ahead of Greece. Euromoneyranks Chile as less risky than Japan, Korea less risky than Italy, Malaysia less risky than Spain, and Brazil less risky than Portugal.

Largely as a result of their improved fiscal situations during the period 2000-2007, many emerging markets were able to bounce back from the 2008-2009 global financial crisis more quickly than advanced countries.

What explains the ability of some countries, particularly emerging market and developing countries, to escape the trap of procyclical fiscal policy? Many researchers have pointed to the importance of institutions. In new research we find that the cyclicality of a country’s fiscal policy is inversely correlated with the country’s institutional quality (which includes measures of law and order, bureaucracy quality, corruption, and other risks to investment). The relationship holds also when instrumental variables are used.

Although one thinks of institutions as slow-moving, they can change over time. Chile’s institutional quality has risen strongly since the early 1980s, during which time its fiscal policy has turned from procyclical to countercyclical. A country with good institutional quality in the general sense of rule of law can help lock in countercyclical fiscal policy through specific budget institutions. Chile did it with the structural budget reforms of 2000 and 2006. Chile’s approach could be emulated by others.

Fiscal rules, such as euroland’s Stability and Growth Pact, may accomplish little in themselves. Rules can actually worsen the tendency of governments to make overly optimistic forecasts for economic growth and budget balance. Chile’s key innovation was to give responsibility for forecasting to independent expert commissions, insulated from politicians’ wishful thinking.

Even advanced countries have something to learn about countercyclical fiscal policy from Chile and others to the South. Saving during expansions such as 2001-06 is critical for weathering the storm in recessions such as 2008-09. Otherwise there may be no way out but to adjust at the worst possible time.